Quarantined at home, U.S. consumers spent the month of April flocking to online channels to purchase goods and services.

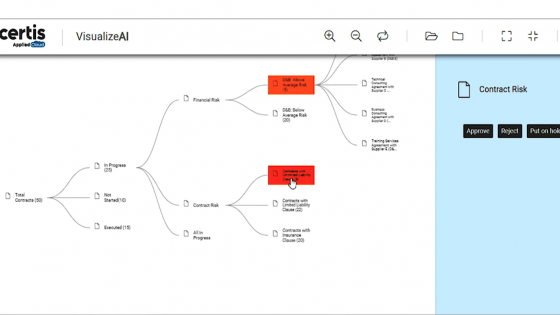

That’s according to this month’s Adobe Digital Economy Index (DEI), which uses Adobe Analytics to track the state of e-commerce. The key finding: Online shopping has become the primary means of commerce during COVID-19.

“We’ve found that this sudden e-commerce acceleration is having an impact on apparel, electronics, and grocery purchases online,” said John Copeland, vice president of marketing and customer insights at Adobe. “With stores closed due to shelter-in-place mandates across the country, April’s Digital Economy Index highlights some of the ways in which brands in these categories have had to shift strategies during this unprecedented time and how consumer online shopping is evolving.”

The DEI is based on over a trillion of anonymised and aggregated visits to retail websites and tens of millions of product SKUs across 18 categories from 80 of the top U.S. 100 retailers. The analysis also found that buy-online, pickup-in-store (BOPIS) orders surged 208% year-over-year (YoY) in April—another sign of people trying to limit their exposure to the coronavirus, in this case, by limiting their time in and around the store.

Here’s a closer look at some other April trends the DEI uncovered.

People have more digital purchasing power. Overall, the DEI found that U.S. digital purchase power—which measures how much more people can buy online now vs. when Adobe started tracking in 2014—grew 4.1% YoY in April. That means consumers can now get for $100 what would have cost them $104 this time last year.

“Years of consistent online deflation have helped cushion the blow of increasing prices, emerging because of COVID-19,” Copeland explained. “Aggregate digital purchasing power continued to increase in April, and we believe it is due to pronounced deflation in apparel.”

Online shoppers get early discounts in apparel. Apparel retailers, DEI found, have been battling store closings with steep e-commerce discounts to rally sales momentum online. Online prices for apparel dropped by 12%, which is the largest April price drop in five years. Also, of note: The average month-over-month (MoM) price decrease from March to April has been about 2.9%, on average, over the past five years. This year that MoM price drop was more than four times greater, to 11.9%, according to the DEI. Overall, apparel has seen a 34% increase in online sales — even though prices dropped dramatically.

“Apparel,” Copeland said, “is experiencing discounting in April that is akin to the scale of discounting that certain categories experience during the Black Friday through Cyber Monday holiday sales period.”

According to Copeland, it’s typical for apparel prices to drop during the May – June time period, when off-season clothing goes on clearance. However, he also noted that it’s hard to predict whether that drop will be amplified this year, noting, “Nothing has been typical during COVID-19.”

Interestingly—and perhaps unsurprisingly — is the type of apparel consumers are now buying, which shifted towards more comfortable, stay-at-home clothes in April. DEI found that pajama e-commerce sales, for example, increased more than 143%, while pants sales dropped 13% and jackets 33%. Consumers also spent money on summer clothing, with shorts and T-shirt e-commerce purchases up 67% and 47%, respectively.

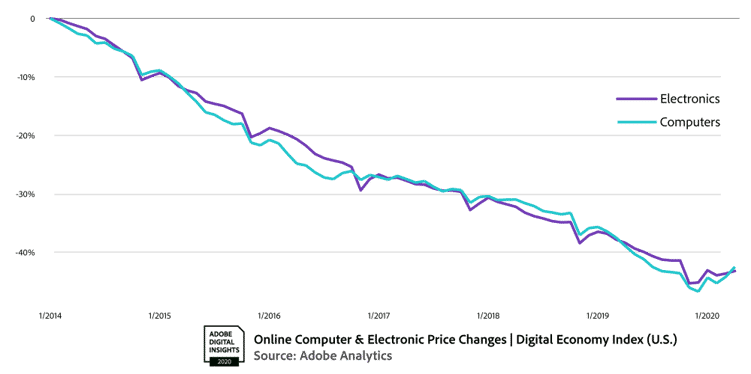

Electronics sees inflation for the first time in years. In the electronics category — where prices have been experiencing deflation at steady rates since 2014 — the picture is very different. Electronics sales are up 58% online, with COVID-19 inflating electronics prices for the first time in years.

DEI found that computers, in particular, were more expensive in April due to sheer demand. Electronics prices, as an overall category, are also on an upward trajectory. “It’s unlikely that consumers will continue to experience favourable pricing online for electronics,” Copeland said. “Supply chain impact may even exacerbate these price changes in the coming months.”

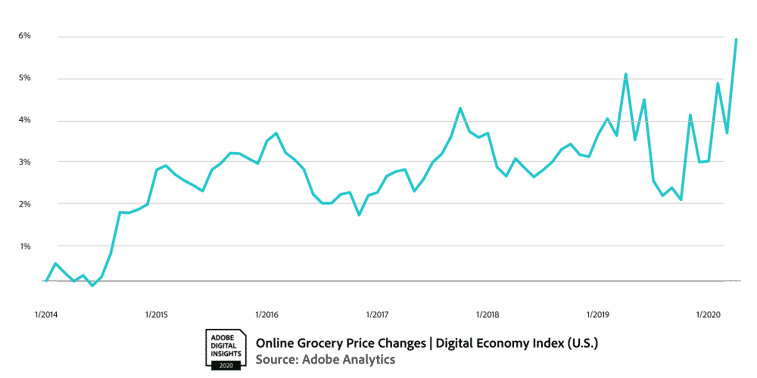

Online shopping for groceries: The new norm. Online grocery shopping in the U.S. has seen a 110% boost in daily online sales in April, according to DEI. All the while, online grocery prices slightly increased in April but stayed in line with January – March 2019 levels.

Over the past five years, aggregate e-commerce grocery prices have decreased in the March – August time frame, before going back-up September through the end-of-the-year holiday season. Copeland says it remains to be seen whether this pattern will hold, depending on how the COVID-19 situation progresses.

“We’re in a landscape where suppliers are hiking up costs on certain goods for grocers, and we’ll continue to track whether those costs will be passed on to the consumer in e-commerce channels,” Copeland said.

Another noteworthy finding: E-commerce purchases of wine, beer, spirits, and accessories (like wine glasses and corkscrews, for example) saw a 74% increase in April, as consumers look for ways to wind down, kick back, and relax.

Get the full analysis and stay tuned for DEI updates here.

Do you have an article, infographic, podcast, presentation slides, press release or a key individual from your organisation that you'd like to highlight on Marketing In Asia? Head on over to Upload Your Content for more info.