- Indonesia is number 2 globally for finance app installs, with almost 11 out of 100 app installs in the country being a finance app.

- Loan apps form the biggest segment of finance apps in APAC and Indonesia, forming half of all finance apps installed.

- Increasing prevalence leading to increasing marketing budgets to stand out amongst competition.

- Finance apps susceptible to app install fraud, with their high payouts and massive scale.

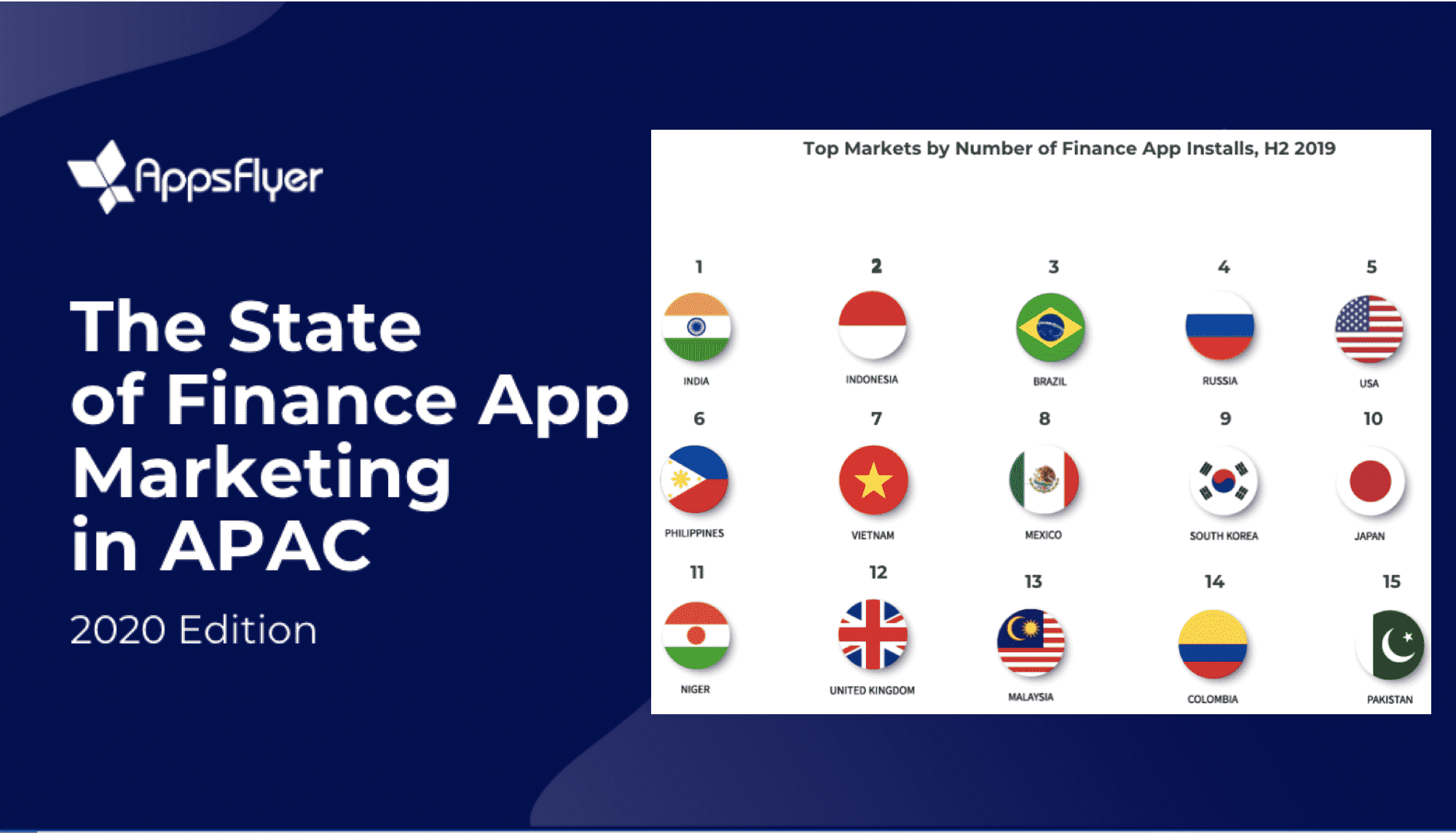

AppsFlyer, the global attribution leader, released its first ever edition of the State of Finance App Marketing report, which tracked 4.6 billion app installs across more than 3,000 different apps globally since H2 2017 to H2 2019, including the Southeast Asian markets of Indonesia, Philippines, Malaysia and Vietnam.

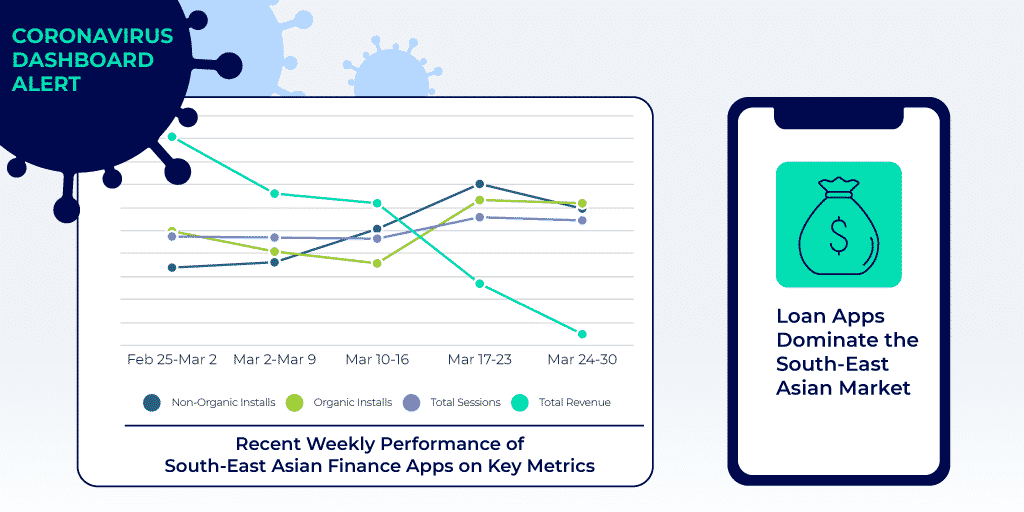

The data found that finance apps have one of the highest growth rates across all apps, forming 4.5% of all apps installed globally, and almost doubling (87% growth) in the past year (from 2.4% in H2 2018 to 4.5% in H2 2019). Finance apps are especially installed in developing markets – Asia Pacific (APAC) saw a 106% increase from 2018 to 2019 for installs, just after LATAM at a 128% increase. Specifically, in Indonesia, Finance Apps saw a significant increase from 2.3% of all app installs in the country in 2017, to 11.3% in 2019, showcasing the mobile-first nature of Indonesians.

This trend towards finance apps is especially prevalent in Southeast Asia – globally, four Southeast Asian countries are in the top 15 markets by the number of finance app installs in 2019: Indonesia (no. 2), Philippines (at no.6), Vietnam (no. 7), and Malaysia (no. 13).

“Asia Pacific, and Southeast Asia in particular, is home to a large unbanked population. However, it also has one of the fastest growing digital and mobile-first populations in the world. People in the region use their mobile phones for a whole range of lifestyle activities, including for their financial needs. This is especially relevant today, as the global COVID-19 pandemic is affecting access to financial services. People across the world are staying at home, and app usage is on the rise, especially with payment, lending, investment and banking apps,” said Ronen Mense, Managing Director & President, APAC, AppsFlyer.

In Asia Pacific, loan apps form the biggest segment of finance app categories, at almost half or 49%.

This is the same in Indonesia – with Loan apps forming 49% of all finance apps installed in the country, followed by Investment apps (28%), Financial Services (16%), and Traditional Banking apps (8%).

In Asia Pacific, this growth of finance apps has also led to increasing competition, with many different apps with similar offerings. This has led to a decreasing number of installs per app in the region, with a 19% drop in the number of installs per app since 2018 as compared with 2019. The competition has resulted in increasing App Marketing Budgets – the report shows a high share of non-organic installs amongst apps with a marketing budget. In Indonesia, overall non-organic installs represent an average of 63% of installs per app.

At the same time, finance apps – with their opportunities for massive scale and high payouts – are an extremely attractive target for fraudsters. Mobile app install fraud rate is high in APAC, with almost 30% of all Finance App installs in the region being fraudulent. In Indonesia, this is higher at 46% – an indication that fraudsters are taking advantage of marketers who are using a Cost Per Install model, where marketers have to pay for the number of installs. Methods commonly used are using bots, device farming, install hijacking and click flooding.

This is followed by Investment apps (25%), Financial Services (18%), Digital Banking (5%), and lastly a small share of Traditional Banking apps (3%), showing that the region has a large unbanked and underbanked population.

Read the AppsFlyer Performance Index here.

Do you have an article, infographic, podcast, presentation slides, press release or a key individual from your organisation that you'd like to highlight on Marketing In Asia? Head on over to Upload Your Content for more info.