- Digital payments are now predominant in the purchasing process – with over 90% of consumers having used cashless payment methods both online and in-store

- Three-quarters (84%) of consumers surveyed are willing to share personal data in return for incentives

- Physical stores remain the predominant choice for the Malaysian shopper to make their purchases, followed by mobile apps

Malaysia. Despite the worldwide boom in online retail over the past years, shopping in physical stores is still key for consumers worldwide – but only if the purchasing experience integrates all sales channels, innovative technology and data-driven incentives. These findings are part of a global study of 6,000 consumers in select countries in Europe, APAC and the Americas, commissioned by Wirecard, the global innovation leader for digital financial technology.

“Our research has revealed that consumers clearly desire choice when completing purchases. Consumers shop in many different ways nowadays and this is challenging merchants to meet a wide range of retail demands,” commented Markus Eichinger, EVP Group Strategy at Wirecard. “A lot of focus is put on pricing, but not necessarily on the flexibility customers seek. A unified commerce strategy, with a focus on a consistent and frictionless buying journey, is integral to offering consumers the experience they would expect from any modern retailer. In the future, brick and mortar stores will only exist if they are technologically advanced with the latest in-store innovations and a fully integrated ecommerce backend.”

Key findings

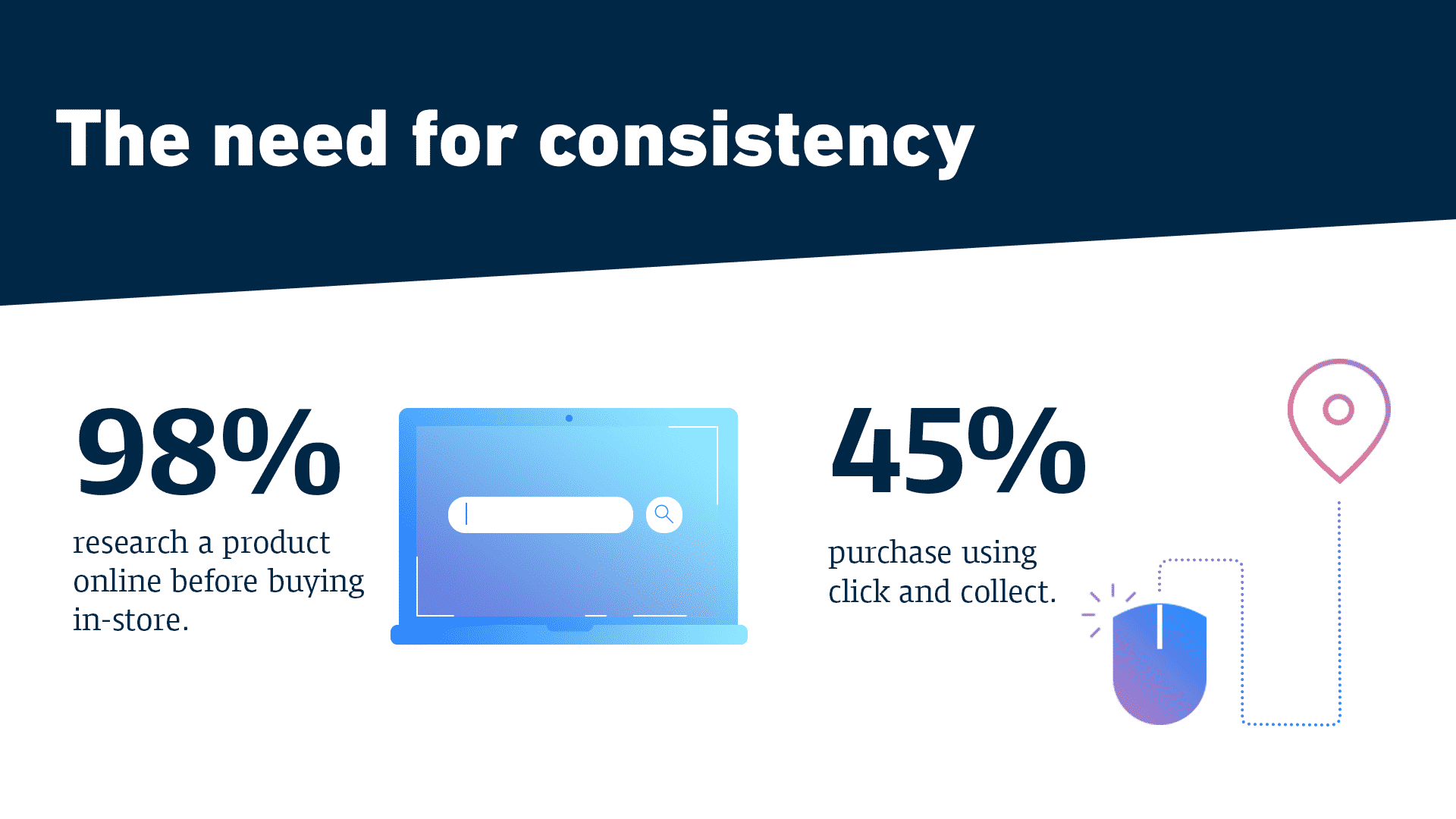

Consumers need consistent offerings across all sales channels: While 68% of shoppers in Malaysia are most likely to purchase in-store over the past 12 months, the research shows that consistent cross-channel experiences are vital to consumers. 9-in-10 either research the products they want to purchase online before buying in-store afterwards (98%) or vice versa (97%). Malaysians would prefer to use an app or the store website via their phone (87%) to do research while in-store, compared to other methods like in-store screens or a VR booth.

Merchants not offering Unified Commerce possibilities will lose out: The rise in popularity of more advanced cross-channel purchasing options, such as buying online and then picking up in-store (BOPIS), further supports this finding. 45% of Malaysians purchase through click-and-collect options, where they buy online and collect in-store. 80% of Malaysian respondents say that if a brand or merchant doesn’t offer these kinds of options, it would have at least some influence in their decision to shop there.

Shoppers are “always on” so maintaining an up-to-date online shop is key: While physical stores are the preferred buying location, how and when people find goods varies, with online browsing offering shoppers the most convenience. Consumers will shop online most often while they are relaxing (82%), in bed (48%), watching TV (40%) and while on holiday (40%).

On average, Malaysians order products from a foreign website 18 times a year, with half (58%) doing so at least once every month. They do so to get products not available locally (70%) or are cheaper (51%). However, the majority of shoppers (95%) indicated that the lack of a familiar payment method would influence their decision to order products from a foreign website.

Consumers appreciate data-driven services and offerings: The vast majority of consumers value data-driven, customer-centric value-added services with loyalty programs. 84% of Malaysian consumers reported that they would be willing to give retailers personal information in exchange for incentives such as a larger discount. Most Malaysian shoppers (92%) use loyalty programs, with 40% preferring to accumulate loyalty points through their mobile apps and phone numbers, similar to countries like Hong Kong and Singapore.

Cashless payments are omnipresent: Nearly all (93%) respondents are now using cashless payment methods when they shop in physical stores. The main reasons for paying cashless in-store is speed (40%), ease (25%) and security (23%). More than half (55%) of the Malaysians surveyed indicated that they are less likely to shop at a physical shop if it did not offer ways to pay via their mobile phones, compared to the global average of 45%.

Other key findings from the research include:

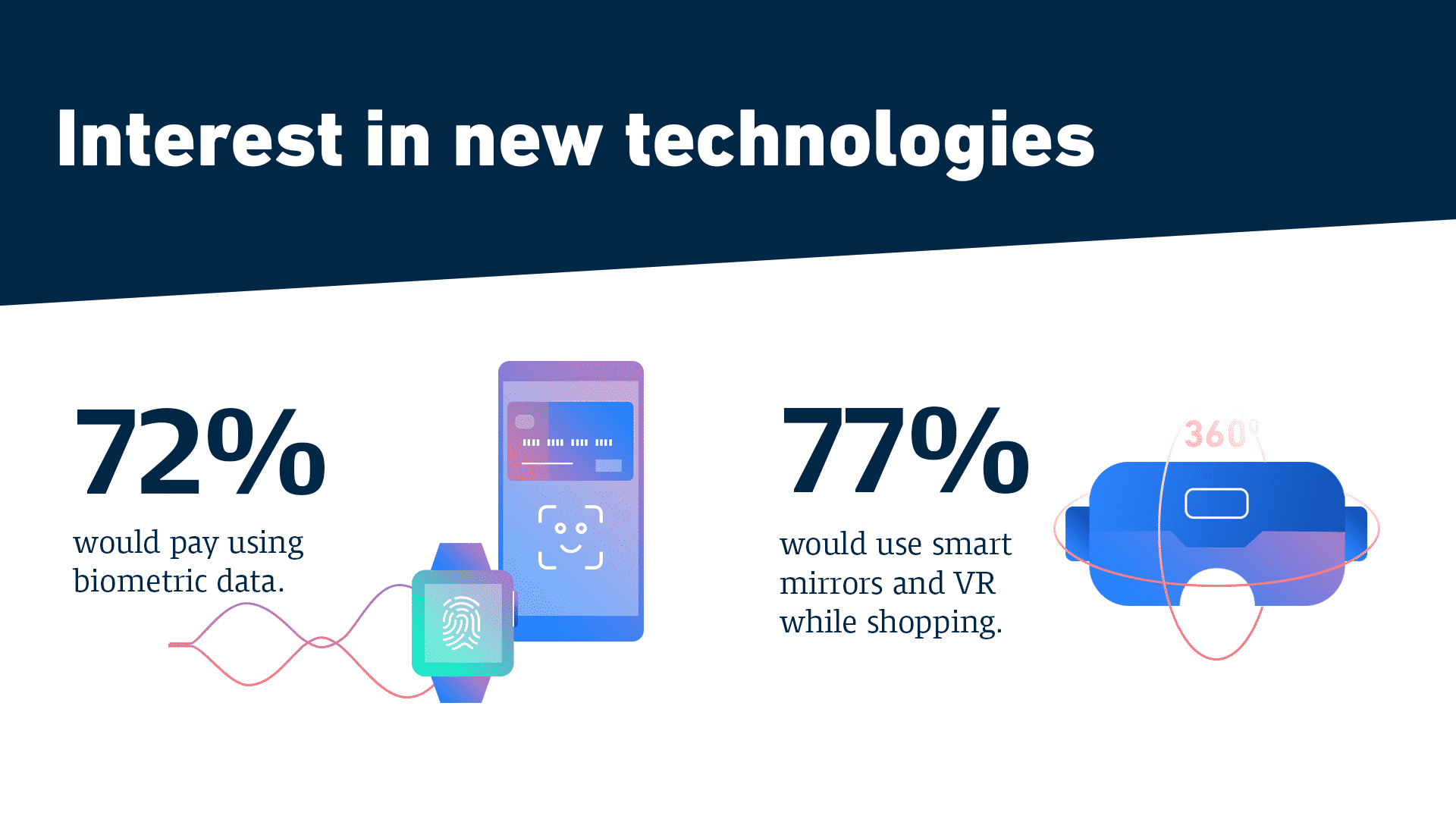

- 72% of Malaysian shoppers are interested to use biometric data e.g. facial recognition, fingerprint) to purchase products in-store and online

- Consumers would spend an average of RM63 more if the payment is authorized with biometric data compared to a cashless payment that does not need authorization

- When shopping in-store, Malaysians’ preferred method of payments are: swipe debit/credit card (63%), mobile wallets (42%) and contactless card payment (32%)

- 77% are interested to use technologies like mobile apps, smart mirrors and VR while shopping

- Environmentally-friendly options resonates strongly with Malaysians, with 86% citing that being environmentally-friendly is a major purchase factor and 88% of respondents saying they would be willing to pay more for these products

“Retailers that want to engage with their customers via targeted offers, and improve their service across all channels need to leverage on customer data. Our report shows that if customers can see a concrete benefit when it comes to providing personal information, they are willing to share it with retailers, thus providing merchants critical data which they can analyze to optimize their offerings and improve customer loyalty,” continued Markus Eichinger.

The Wirecard digital financial commerce platform allows merchants worldwide to easily combine their distribution channels and meet the needs of today’s consumers. Wirecard offers a constantly expanding ecosystem of real-time value-added services built around innovative digital payments.

The international survey was carried out by Vanson Bourne on behalf of Wirecard in Q4 2019. A total of 6,000 consumers over the age of 18 in select countries like Australia, Brazil, France, Germany, Hong Kong, Malaysia, Philippines, Singapore, Thailand, the U.K. and the U.S. provided answers.

For further insight and more information about consumers’ shopping behavior, download the Wirecard Global Shopping Report.

Make “Work From Home” Work For You

Do you have an article, infographic, podcast, presentation slides, press release or a key individual from your organisation that you'd like to highlight on Marketing In Asia? Head on over to Upload Your Content for more info.