Author, Samantha Gkonos

The Asia-Pacific spending boom has taken hold in recent years, as incomes have risen and credit becomes available. Large emerging markets with strong economic growth, such as China, are especially key in driving this trend and creating a sense of retail buzz across the region. Consumers have money to spend and they’re keen to spend it, which makes Asia-Pacific a compelling prospect for international brands.

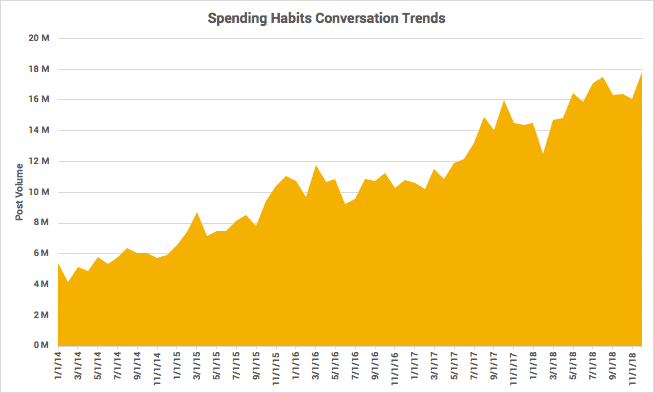

One of the best ways for brands to understand their customers is by following the many clues they leave online. In particular, there’s good news for financial services brands wanting to learn what their customers think – more people than ever before are going online to openly discuss how they prefer to spend their money.

Numbers are huge, and growing fast, as the below chart shows. Over the past five years alone, the discussion volume about money and spending has grown from about 5 million posts per month to 18 million.

This represents a massive opportunity for financial services brands to get ahead of the competition, as those that don’t take advantage of it may find themselves falling further and further behind.

Millennial divide

We now know that regional conversation about spending habits is growing fast. But this is just a starting point. It’s also important to find out what exactly spending habits look like across the different generations, from young to old.

The generation known as millennials has developed very different spending habits and priorities compared to those of previous generations. No matter how different they seem on the surface, all generations have certain budget items in common, such as utilities, groceries and other essentials. It’s what consumers choose to spend money on that truly reveals the full picture of their preferences and tastes.In order to understand our audiences, we can break down their overall spending discussion into more specific categories.

The data shows us that Millennials are the most interested in spending on retail, Gen X prefers spending on homes and eating out, while Gen Z is most interested in spending on travel. In fact, members of the latter group, who have never known a non-digital world, are set to outstrip millennials in travel by the end of 2019.

For all groups, the smallest slice of the discussion focuses on groceries, perhaps due to the less compelling nature of this category. What’s more, all groups have travel as their largest spending interest, which likely reflects a rise in cheap flights and a flurry of travel influencers inspiring consumer buzz via social media.

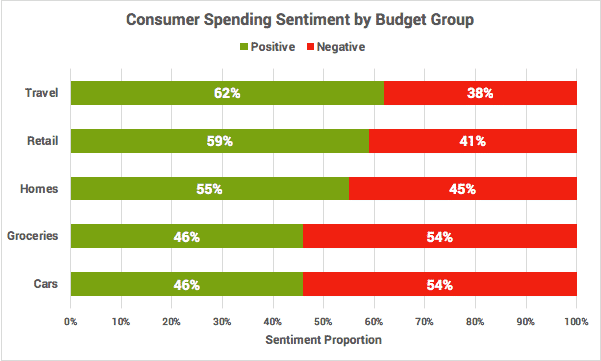

Retail therapy

It’s useful to know what areas consumers are keen to spend their money on, but how do they actually feel once they’ve spent it? On balance, people are likely to be happier when spending money on things they actually want, as opposed to necessities like rent, utilities or groceries. As might be expected, travel attracts the largest chunk of positive sentiment and the lowest negative. Cars and groceries are as unpopular as each other, attracting the highest levels of negativity.

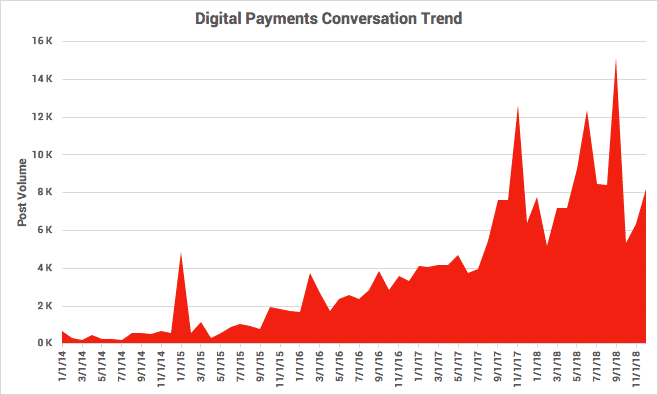

App power

We know what people are interested in buying and we also have some idea of how this spending makes them feel. But what about how they spend? In Asia-Pacific, interest in digital payments is booming, driven by a proliferation in smartphone use and better internet access. As seen below, regional talk about payment apps has skyrocketed from almost nothing to a peak of around 15,000 posts per month.

And it’s not only payment apps that are capturing hearts and minds; other innovative methods like QR codes, digital wallets, and stored value cards are also making their mark among the region’s consumers.

Conclusion

The behaviour and habits of Asia-Pacific’s personal finance consumers are changing fast. As the region’s consumers become more engaged and digital, they can take advantage of a whole host of digital banking options, including challenger banks and fintech firms ready to meet their banking needs. For brands looking to get ahead in this space, gaining insider knowledge of consumer spending interests, emotions and approaches is a clear path to gaining a vital competitive edge.

Financial Literacy Is A Miracle

Brandwatch is the world’s leading enterprise social intelligence company, allowing users to analyse and utilise conversations from across the social web. The perfect platform to make sense of the chatter about your brand online, Brandwatch also lets users engage with the communities they have isolated, responding to, assigning workflow and managing social media mentions with ease. Follow them on LinkedIn or visit their website for a personal demo.