Author: Dennis Mink

The end of the year is upon us and Southeast Asian consumers are celebrating it with massive online shopping sprees. This isn’t just about the typical end-of-season store clearances with people doing last minute shopping for the holidays, rather it’s more to do with the mega 11.11 and 12.12 sales cropping up on e-commerce platforms over the past few years.

The numerical repetitions sales like 11.11 are great at catching the attention of shoppers on multiple devices. The tradition traces its roots back to Singles Day – an unofficial holiday in China for bachelors which has been popularised across Asia since Lazada latched onto it, and is now the largest 24-hour shopping event in the region. Indeed, this year’s 11.11 sale was the biggest sale ever recorded by the Chinese tech giant Alibaba, achieving over US$38 million in gross merchandising value (GMV) and Lazada e-commerce marketplace receiving over three million orders within the first hour.

Meanwhile, Singapore-originated Shopee has also enjoyed much end-of-year shopping success with its 12.12 Birthday Sale receiving 80 million visits and selling 80 million items.

With these sorts of records, 11.11 and 12.12 have shaped up to be the most hyped-up shopping fests on the e-commerce calendar. Yet, the hype’s merely stoking the online shopping fires that are becoming so normalised in today’s culture of Southeast Asian shoppers. Here’s what app marketers should be looking at to understand them better.

Mobile commerce –Southeast Asia’s internet economy engine

According to the e-Conomy Southeast Asia 2019 report by Google, Temasek and Bain & Company, the region’s internet economy was valued at a massive US$100 billion and shows no signs of slowing down, as the sector is expected to triple to US$300 billion in 2025. That’s just over five years from now. Additionally, online commerce – according to Forrester Research – will grow to US$53 billion by 2023 and will comprise 6.5% of all retail sales.

Both the e-Conomy Southeast Asia 2019 report and Forrester’s insights note that mobile is the main driver of this growth. This comes as a little surprise with half of Southeast Asians connected to the internet and 90 percent of them accessing it via their phones. This effectively makes them the most engaged internet users globally – using it to connect to their families and social circles, seek entertainment, learn new skills and, of course, shop.

Just a decade ago, this would’ve been unimaginable as four in five Southeast Asians had little to no internet connectivity. Now, internet engagement, especially on mobile, is taking place a million times a day.

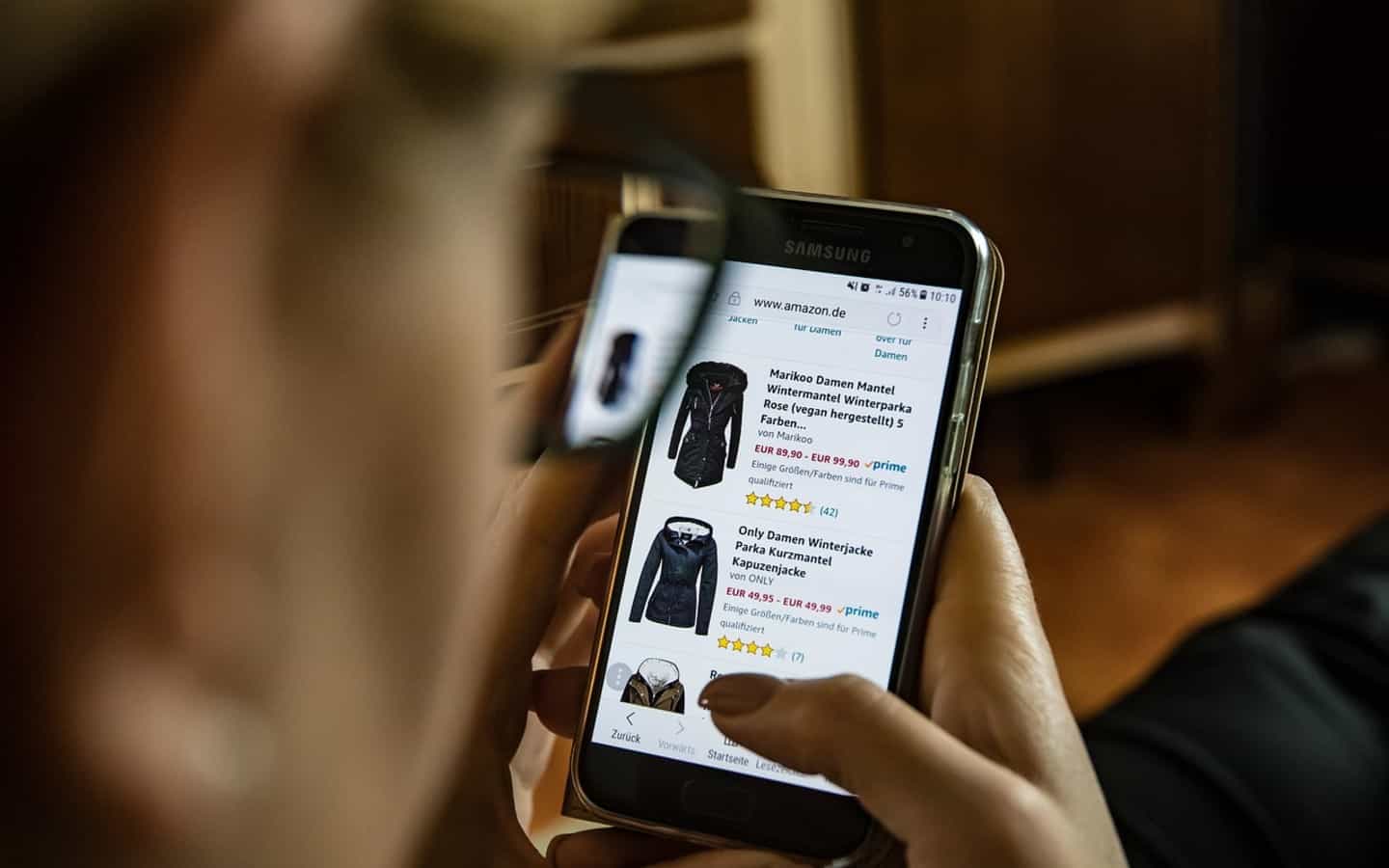

Shoppers’ eyes are on their phones

The mobile-first mentality of Southeast Asian shoppers means that their phones now play a much greater role in helping them discover shopping deals and ideas – to the point that it has become the go-to shopping channel for year-end bonanzas such as 11.11 and 12.12.

Based on findings from a Facebook IQ survey, a large portion of Southeast Asian shoppers noted their preference for mobile-first end-of-year shopping experiences. This is because the way we’ve conventionally viewed shopping has changed. People aren’t going shopping; they’re always shopping.

This has been thanks to the convenience that mobile shopping apps provide and empower consumers to shop anytime and anywhere. In fact, people are doing their mobile shopping in the stores themselves, as the Facebook IQ survey found that 73 percent of shoppers in four Southeast Asian countries said they use their phones while shopping in a physical store.

Ramping up engagement in a mobile-first environment

Mobile app marketers need to take all these factors into consideration when developing an engagement strategy. If eyeballs are mostly on phones, you need to understand which sort of apps the shopper would likely be using outside the shopping apps themselves. The Facebook IQ survey showed that popular social media sites like Facebook and Instagram are big influencers on their decisions, and therefore user retention rates are likely higher in markets which are social media savvy. This was what we found in our 2019 Mobile Shopping Apps Report, which showed that Singapore has the highest mobile retention rate in Southeast Asia, as a majority of the population are heavy social media users.

This is backed up by Adjust, a mobile measurement company, which in 2018 measured the average daily retention rate of users in Southeast Asia who come back to use the app on a specific day. It was found that Indonesia had the highest Day One retention rate at 24 percent, and by day 30, dropped to 6 percent. Singapore, as mentioned above, had the second highest retention rate at 22 percent, which dropped to 8 percent on day 30.

As the mobile app economy grows in Southeast Asia, mobile marketers will need to focus on re-engagement and retention. Maximising opportunities requires shopping apps to prioritise mobile users during marketing campaigns through engaging content, i.e. vertical and short-form videos that highlight what users get by downloading the app, especially during mega-sales such as 11.11 and 12.12. This can then be amplified by content produced by social media publishers or influencers.

Southeast Asia is undoubtedly the fastest growing and most dynamic region in the world when it comes to online shopping. While being a goldmine for mobile app marketers, only those who understand how to take advantage of mobile engagement strategies can fully realise the opportunities it presents.

Dennis Mink is the Vice President of Marketing at Liftoff.

Do you have an article, infographic, podcast, presentation slides, press release or a key individual from your organisation that you'd like to highlight on Marketing In Asia? Head on over to Upload Your Content for more info.